Introduction

Parametric insurance defines payouts in advance based on measurable, objective events rather than traditional claims adjustment.

In the context of cyber and digital infrastructure, these products aim to cover outages or significant slowdowns in connectivity, cloud services, or digital platforms.

KASPR Datahaus provides the two foundational components needed for such products:

- Long-term, consistently collected historical data for risk pricing and model calibration.

- Real-time network monitoring for automated, verifiable trigger activation.

Historical Data for Pricing and Risk Modelling

Developing a sound pricing model for parametric cyber-outage or slowdown insurance requires extensive and consistent historical data.

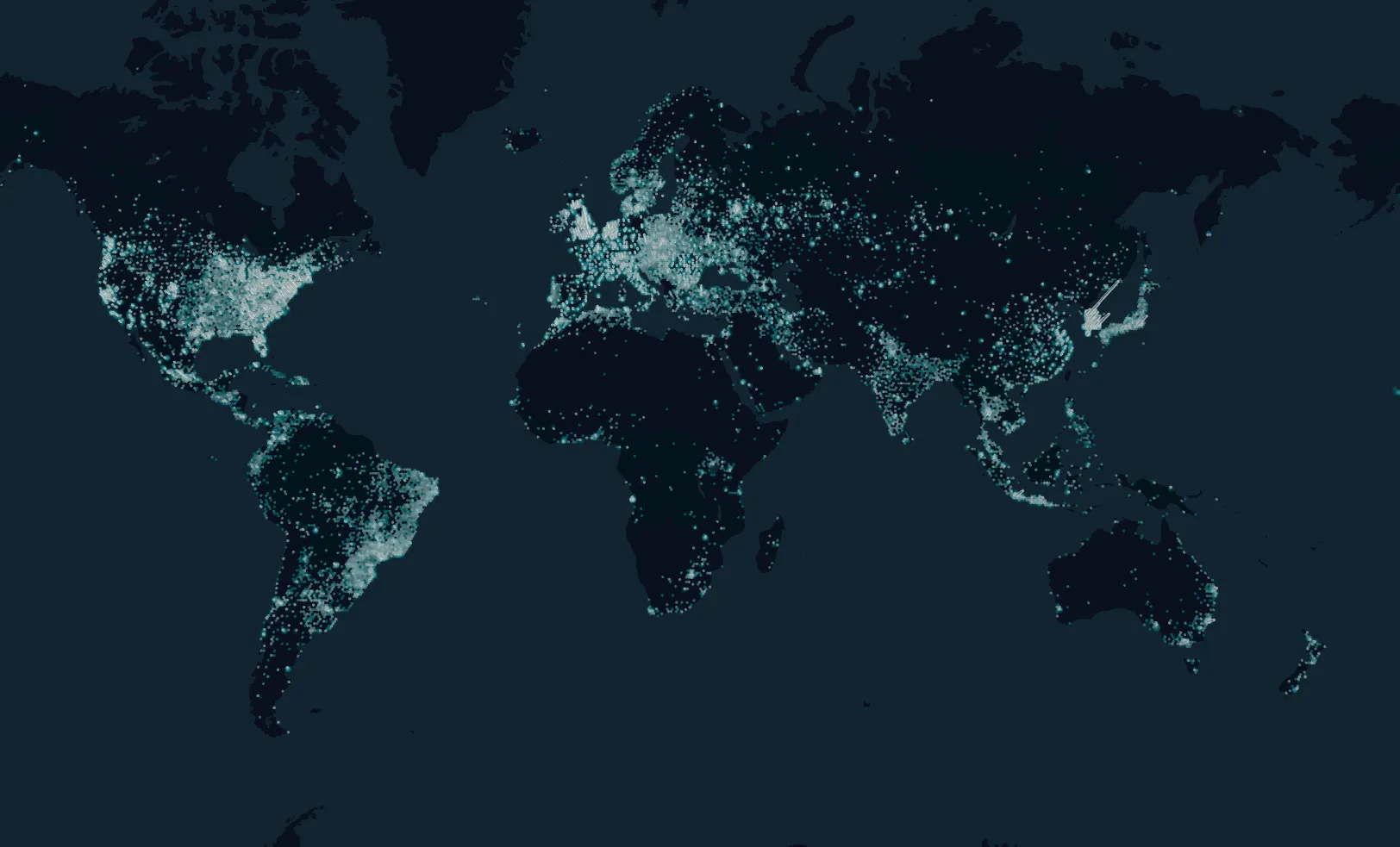

KASPR’s dataset, spanning over five years of continuous measurements across millions of endpoints, enables insurers to model:

- Frequency and severity distributions of outages and slowdowns.

- Temporal and geographic correlations across regions and providers.

- Baseline behaviour and structural changes in network performance over time.

This historical data allows insurers and reinsurers to construct statistically robust loss distributions and to calibrate thresholds and payout levels.

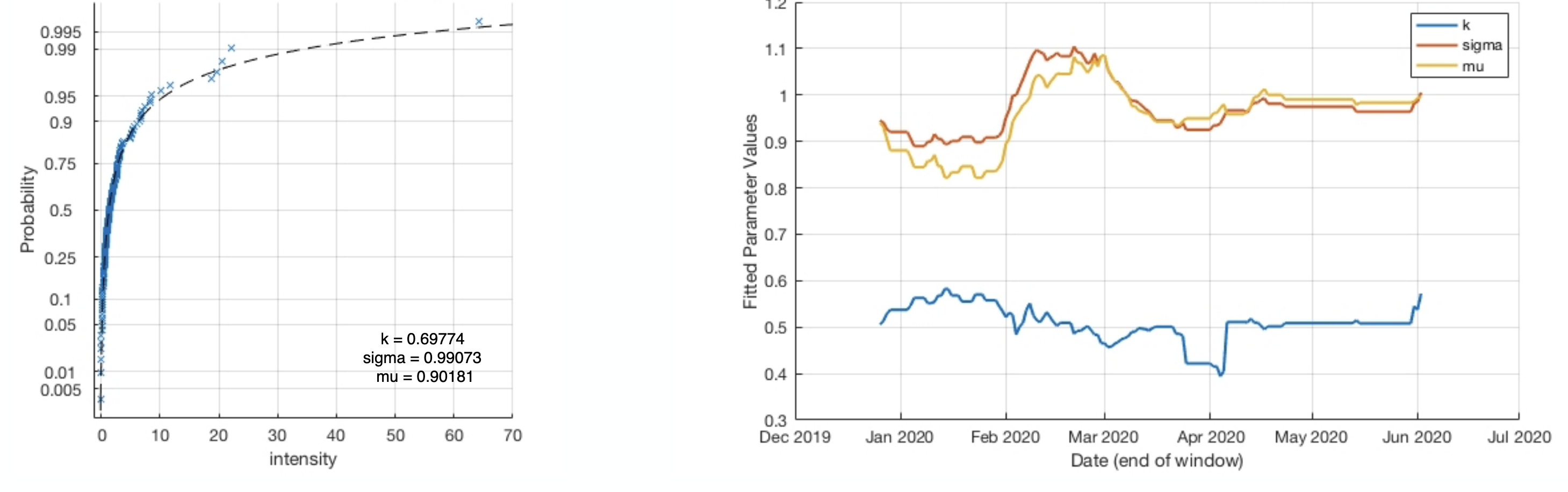

The figure above illustrates how KASPR’s historical intensity data can be used to fit statistical distributions (with parameters k, σ, μ).

These distributions inform event likelihood and severity modelling—core components of premium calculation and trigger design.

Why long-term data matters:

- Enables credible estimation of low-probability, high-impact events.

- Provides confidence in pricing and reinsurance models.

- Reduces “basis risk” by aligning trigger definitions with observed behaviour.

- Supports cross-regional comparisons and segmentation in underwriting.

In parametric insurance design, pricing accuracy depends on understanding both event frequency and loss magnitude.

KASPR’s consistent, high-resolution data series provides the empirical foundation for these assessments.

Real-Time Monitoring for Trigger Activation

For parametric cyber policies, the trigger mechanism is central—it must be:

- Objective (based on measurable metrics such as latency or packet loss),

- Timely (detectable in real time), and

- Verifiable (auditable and reproducible).

KASPR’s real-time monitoring infrastructure meets these requirements.

It continuously measures internet latency, packet loss, and reachability across networks and geographies, allowing insurers to detect outage or slowdown events automatically.

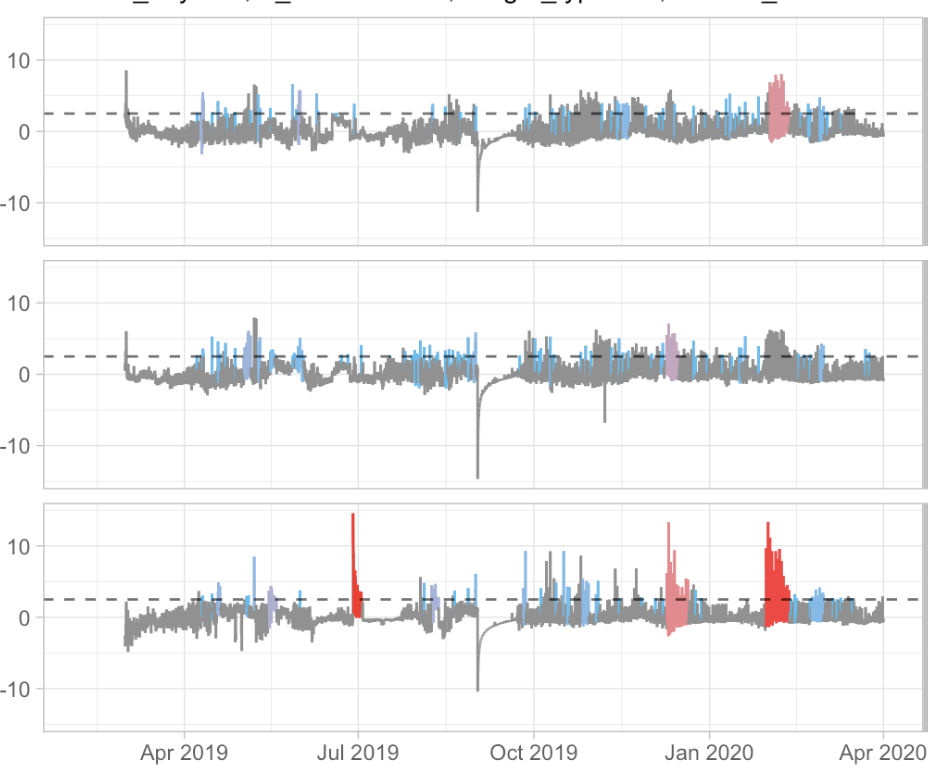

As shown above, KASPR’s system captures and highlights anomalies in near real-time.

This capability supports automated policy triggers, such as:

- Latency exceeding a defined threshold for a specified duration.

- Packet loss above a given level across a monitored region.

- Sustained connectivity degradation at customer endpoints.

Advantages of automated real-time triggers:

- Immediate and transparent payout decisions.

- Reduced need for subjective claims verification.

- Lower administrative overhead.

- Enhanced trust between insurer and insured.

The integration of automated detection and timestamped data ensures that triggers are reliable, independent, and audit-ready, reducing disputes and improving operational efficiency.

Combining Historical and Real-Time Capabilities

Together, KASPR’s historical and real-time data capabilities enable a complete parametric insurance framework:

| Stage | KASPR Contribution |

|---|---|

| Pricing & Structuring | Long-term historical data for frequency–severity modelling and trigger calibration |

| Trigger Definition | Quantitative thresholds for latency, downtime, or packet loss |

| Event Monitoring | Continuous measurement of internet performance |

| Automated Payout | Real-time verification of trigger conditions |

| Recalibration | Ongoing adjustment of pricing and trigger parameters based on new data |

This combination allows insurers to design products that are transparent, data-driven, and scalable.

It also helps mitigate basis risk and provides insurers with the confidence needed to manage accumulation and correlation risks in portfolios that depend on digital infrastructure.

Conclusion

Parametric cyber outage and slowdown insurance relies on two key data pillars:

- Historical data to understand and price network risk.

- Real-time monitoring to detect and verify events that trigger payouts.

KASPR Datahaus uniquely provides both.

Its long-term dataset supports the development and pricing of new parametric insurance products, while its real-time monitoring ensures accurate, automated event detection and payout triggering.

Together, these capabilities make KASPR a valuable partner for insurers and reinsurers seeking to modernize cyber risk coverage through data-driven, transparent, and efficient parametric models.