With a simple one-day look-ahead model and a straightforward trading rule, our analysis shows that KASPR Datahaus (KDH) alternative data can generate an excess return margin of over 7%, relative to a baseline model that excludes our data product.

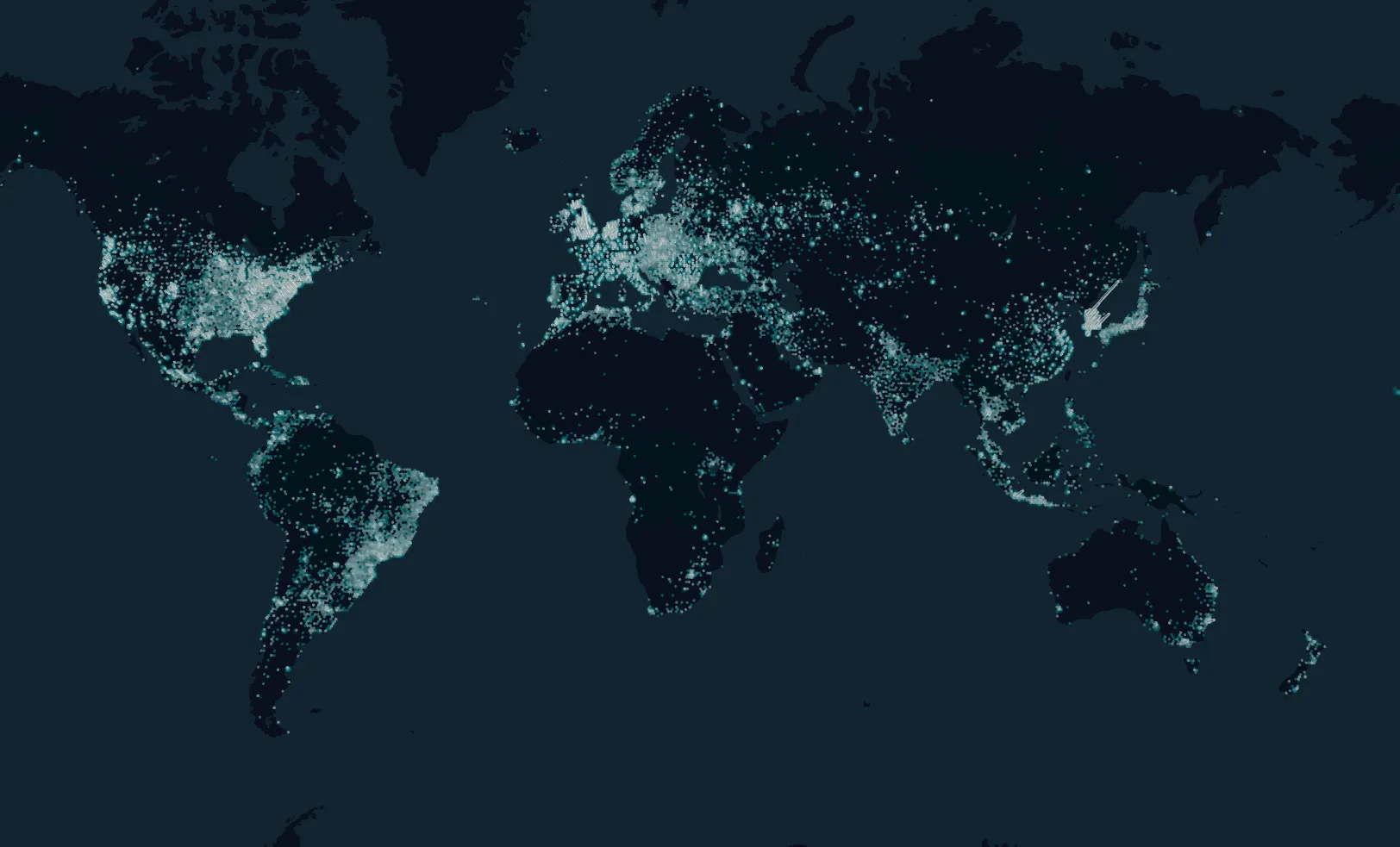

This demonstrates the strong predictive power and informational advantage embedded in our Global ICT Intelligence Data.

How the Prediction Framework Works

We demonstrate how KASPR data enhances prediction accuracy for both the S&P 500 Volatility Index (VIX) and the UK FTSE All-Share Return Index (FTASD).

Training and testing are conducted using a moving window approach — training on features from the day before a given trading day and testing on the subsequent day’s actual outcome.

For stability, each window contains at least 100 days of data.

Figure A. A moving-window train–test prediction analysis demonstrates the strong informational advantage of KDH Alternative Data Products.

The predictive model used is a regression tree ensemble (random forest) with 200 individual trees — a robust, off-the-shelf machine-learning tool well-suited for nonlinear financial relationships.

To assess the incremental value of KASPR data, we compare two setups:

- Models using only traditional market indicators, and

- Models combining traditional indicators with KDH Global ICT Intel data.

This procedure is applied across all trading days in May 2019, using 21 days (FTSE) and 22 days (VIX) of test data after excluding weekends.

Backtesting Results

Predicting the S&P 500 Volatility Index (VIX)

For the VIX, we use the rolling-window train–test design described above, repeating each setup 100 times to generate a distribution of predictive accuracy.

When incorporating KDH Global ICT Intel Data into the feature set, accuracy improves substantially over the benchmark that uses only traditional indicators.

Figure B. Accuracy shift with KDH Global ICT Intel data relative to the traditional benchmark features when applied to day-ahead prediction of the VIX.

Results:

- Average accuracy with traditional features only: 44.3%

- Average accuracy with KDH Global ICT Intel Data: 59.5%

This 15.2 percentage point lift in accuracy highlights how global internet performance data provides a meaningful signal about short-term volatility dynamics in equity markets.

Predicting the UK FTSE All-Share Return Index

We apply the same methodology to the UK FTSE All-Share Return Index, using 21 days of rolling-window test data.

Again, incorporating KDH data results in a clear improvement in forecast accuracy.

Figure C. Accuracy shift with KDH Global ICT Intel data relative to the traditional benchmark features when applied to day-ahead prediction of the FTSE.

Results:

- Average accuracy with traditional features only: 52.4%

- Average accuracy with KDH Global ICT Intel Data: 60.7%

These results confirm that KASPR’s global internet performance data adds unique, predictive value to financial models — capturing real-time frictions and signals that traditional indicators miss.

Conclusion

Across both U.S. and U.K. markets, integrating KASPR Datahaus Global ICT Intelligence significantly enhances predictive performance in short-term financial forecasting.

Our data provides an informational edge rooted in real-world digital infrastructure — transforming internet performance measurements into actionable market intelligence.

Contact us to request the full backtesting report, replication code, and dataset access.

Gain the same edge used to improve forecasting accuracy and drive measurable alpha in your investment strategies.