Financial markets thrive on speed. Every millisecond gained or lost in processing and transmitting information can change how prices adjust to news. In a new working paper — “News, Latency, and Stock Prices” by Klaus Ackermann, Simon Angus, Bei Cui, and Paul Raschky — researchers use KASPR Datahaus’ high-frequency internet quality data to uncover a new source of inefficiency in financial markets: the daily variation in national internet latency.

This research, powered by KASPR’s proprietary connectivity data, demonstrates that the digital backbone itself can generate measurable alpha opportunities for investors.

The Core Idea: Digital Frictions Affect Market Efficiency

The study merges three unique datasets:

- Equity return data from CRSP,

- Machine-readable news sentiment from RavenPack, and

- KASPR’s nationwide internet latency measurements across U.S. Autonomous Systems.

The authors show that when national internet latency increases, the stock market’s immediate reaction to news — both good and bad — weakens. Price discovery slows, volatility increases the following day, and trading patterns shift. In short, digital congestion dampens the speed at which information becomes priced in:contentReference[oaicite:0]{index=0}.

How KASPR Data Enabled the Discovery

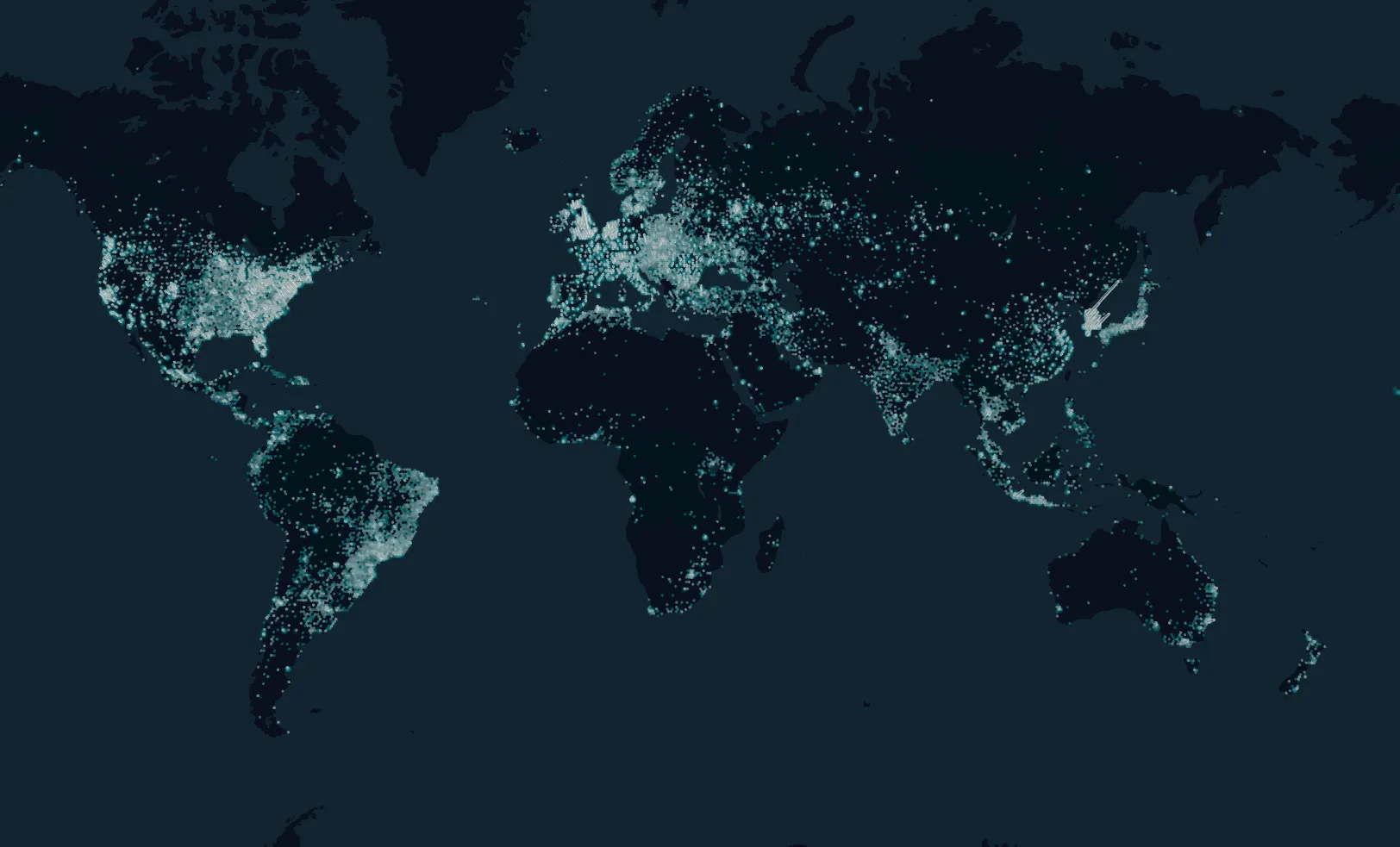

KASPR Datahaus continuously measures round-trip times (RTT) from multiple vantage points to millions of routable IP addresses around the world. For this study, researchers computed the cross-sectional variance of latency across U.S. networks as a measure of “information friction” — a real-world proxy for the unevenness of data transmission.

This granular, time-consistent measure made it possible to test how connectivity fluctuations at the national level influence the market-wide assimilation of news.

By combining over five years of daily KASPR latency data with financial and sentiment datasets, the authors could model how digital bottlenecks shape market reactions on a day-to-day basis:contentReference[oaicite:1]{index=1}.

Key Findings

-

Latency Dampens Immediate Price Reactions

Moving from a low- to high-latency day reduces the same-day price reaction to news by about one-third. The adjustment instead spills over into the following session. -

Delayed Volatility and Return Predictability

The next day’s volatility and autocorrelation rise under high latency — consistent with predictable return drift as information continues to diffuse. -

Liquidity and Retail Participation Effects

Under poor network conditions, positive news leads to weaker trading responses and narrower spreads, while negative news under high latency amplifies volatility.

Retail investors — more reliant on “last-mile” infrastructure — show muted reactions, suggesting that network quality disproportionately affects non-institutional traders:contentReference[oaicite:2]{index=2}. -

Macro-Level Digital Infrastructure Matters

Even in the age of colocation and microsecond trading, broadband reliability still governs how efficiently information flows across markets.

This finding reframes internet quality as a macroeconomic input to financial efficiency, not merely a consumer utility.

From Latency to Alpha

For investors, KASPR’s latency metrics introduce a new systematic factor — digital speed — that can be monitored and potentially traded on.

Periods of elevated latency correspond to slower information diffusion and delayed price adjustment. An informed investor, aware of these dynamics, can anticipate temporary mispricings or momentum spillovers arising from digital frictions.

In other words, real-time monitoring of internet quality can serve as a novel alpha signal, particularly for strategies that rely on timing news-based or sentiment-driven trades. By identifying when markets are “digitally slow,” traders can better forecast short-term return continuation and volatility shifts.

Broader Implications

The results point to a profound conclusion: market efficiency depends on infrastructure.

While exchanges have perfected microsecond trading, the “last mile” of the internet still shapes how quickly public information is absorbed into prices. Regulators, telecom providers, and investors alike have incentives to monitor this digital backbone.

For policymakers, improving broadband reliability isn’t just a social good — it’s an economic efficiency gain. For investors, monitoring latency with KASPR’s data opens a new informational edge in understanding how, when, and where markets misprice news.

About the Study

Paper: News, Latency, and Stock Prices (Ackermann, Angus, Cui & Raschky, 2024)

Data Source: KASPR Datahaus — daily latency and network quality metrics across U.S. Autonomous Systems

Sample: NYSE, NASDAQ, and AMEX equities matched with RavenPack sentiment data

Period: Multi-year panel, over 3.9 million firm-day observations

Key Finding: Network latency reduces same-day news impact by ~33%, increases next-day volatility, and alters retail trading patterns:contentReference[oaicite:3]{index=3}.

Why It Matters for Investors

KASPR Datahaus provides the world’s most comprehensive, real-time measurement of internet performance.

For financial institutions, hedge funds, and quant researchers, our data can:

- Enhance alpha generation by identifying latency-linked inefficiencies,

- Improve risk models by incorporating network infrastructure shocks, and

- Support macro and micro forecasting through high-frequency digital performance indicators.

As markets increasingly depend on digital infrastructure, KASPR’s insights become an essential part of the modern investment toolkit.

Explore KASPR Datahaus

Gain a new edge by integrating global internet quality signals into your trading models.

Learn more at kasprdatahaus.com